Life Sciences: Valuation and M&A – 2022 Report & 2023 Outlook

Jean-Baptiste Duval

DirectorSince the Covid 19 crisis, health issues, once a low priority in European markets, have become one of the main topics of discussion. Investors have not waited for the next global crisis to make the Life Sciences sector generally one of the most valued, with very high acquisition ratios in the context of external growth operations.

This article reviews the 2022 trends in terms of valuation and interest, from investors, whether financial institutions or private investors, as well as the outlook for 2023, for the French market, in a year 2022 that is ultimately much more complicated than initially envisaged.

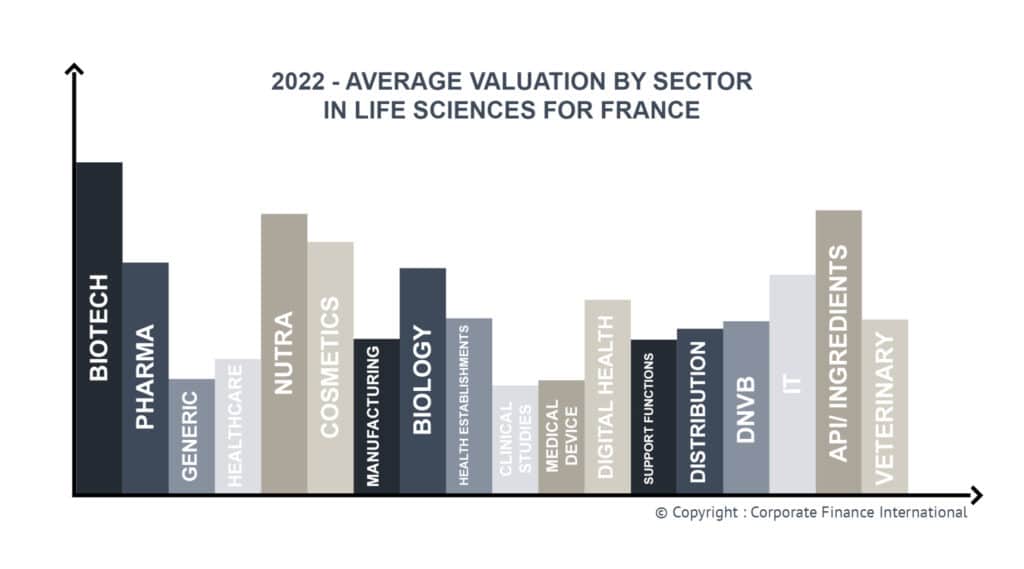

Within CFI, an investment bank specializing in the mid-market market present all over the globe, specialising in mergers & acquisitions and other complex financial operations, the Life Sciences section is divided into different divisions, each with its own dynamic and its own valuation: (1) Biotech, (2)Pharma, (3) Generic, (4) Healthcare, (5) Nutra, (6) Cosmetics, (7) Manufacturing, (8) Biology, (9) Health Establishments, (10) Clinical Studies and associated services, (11) Medical Device, (12) Digital Health, (13) Support Functions, (14) Distribution, (15)DNVB, (16) IT, (17) API/ Ingredients and (18) Veterinary.

2022 Report:

The Biotech sector in Europe is following a general trend, namely that Biotech in Oncology in particular or in pathologies treating orphan diseases (orphan drugs) were the most sought after and valued in 2022, including early stages, even if financing was numerous than over the period 2015-2020. For biotechs outside growth sectors, early financing finds more problems in their financing in Europe (knowing that the US is also suffering, which is new).

The Pharmaceuticals sector remained a value sought by the Funds in 2022, due to the increase in healthcare spending, certain political and structural announcements suggesting a certain future valuation of the sector.

Conversely, investors had already anticipated the difficulties to come in the Generics sector in 2022, with a further reduction in margins for the latter.

This is also the same trend in the sector CFI refers to as Healthcare, which includes OTC drugs, not reimbursed. These products, generally prescribed by the general practitioner, are less sought after in 2022, due to regulatory and promotional constraints relating to drugs, and relatively low prices.

Conversely, the Nutraceutical sector (food supplements) is probably the sector most sought after by investors in 2022.

French Cosmetics and beauty brands remain an asset still sought after by investors. Along with Japan and Korea, this sector remains highly sought after by investors, despite the OPEX associated with this type of activity.

The CDMO market for manufacturers of finished, semi-finished and packaging products follows the movement of finished products. Manufacturers operating in the drug market are currently less sought after than manufacturers of nutraceuticals, except when addressing product niches where competition is weaker (injectables, soft capsules). The valuations can be almost simple to double between a classic pharma manufacturer and a nutra manufacturer. Among industrial subcontractors, packaging players were less valued in 2022.

The Medical Biology market in the broad sense (laboratories, equipment) was not as valued in 2022 as it may have been in the past, due to the concentration already existing on the market, as well as because the profits linked to the Covid crisis have made these companies very expensive.

The Health Institutions market is already highly concentrated and in the hands of many financial institutions. Nevertheless, related sectors (dental, ophthalmology, ENT) were in high demand in 2022 due to less concentration there, and less complex regulatory installation obligations than in the past.

In the Clinical Trials market, some parts of Europe are much more attractive than others. The best valuations related to the client portfolio and the ease of recruitment are found in Eastern Europe, a much more attractive region for CROs. The market remained stable but dynamic in 2022.

The Medical Devices market in 2022 remained stable in Europe, or even a little less sought after, cyclically, mainly due to the adoption of the new (stricter) MDR on medical devices in Europe. This made most investors (financial or private institutions) wait-and-see.

The Digital Health sector is a paradox in Europe. With the exception of Germany, these new applications are still relatively poorly reimbursed, but there are many investors in this sector, with good valuations in 2022 for the real innovative digital health companies.

Services to the Life Sciences sector were quite sought after in 2022, particularly for companies providing regulatory services, pricing and reimbursement, analytics, market analysis, marketing, training, success due in particular to the increase in outsourced services from large health groups.

Distribution essentially concerns 2 types of profile, pharmacies and wholesalers on the one hand, and distributors of finished and intermediate products excluding pharmaceutical products on the other, not to mention the logisticians whose importance we realized during the Covid crisis. For this heterogeneous sector, interest in 2022 has remained high even growing.

The DNVB or Digital Native Vertical Brands were quite sought after in 2022, in particular because of their digital expertise, which the more traditional Laboratories do not have.

Data is at the heart of all analyses. Even if the sector is already very concentrated, it remains dynamic, as can be seen particularly in the Digital Health sector, which in addition to the development of Apps, manages to generate patient data. This sector remained stable in 2022, with bellData is at the heart of all analyses. This sector remained stable in 2022, with good valuations.

Asset Providers, whether pharma or nutra, have been highly sought after companies in 2022. As targets are rare, valuations have been quite high, probably in the top 3 overall with the Biotech and Nutraceuticals sectors.

In the veterinary segment, as small and mid caps targets are rare, valuations remain high and close to pharma, even if the number of deals is lower.

2023 Perspectives:

2023 is starting in an uncertain and difficult context in Europe and around the world.

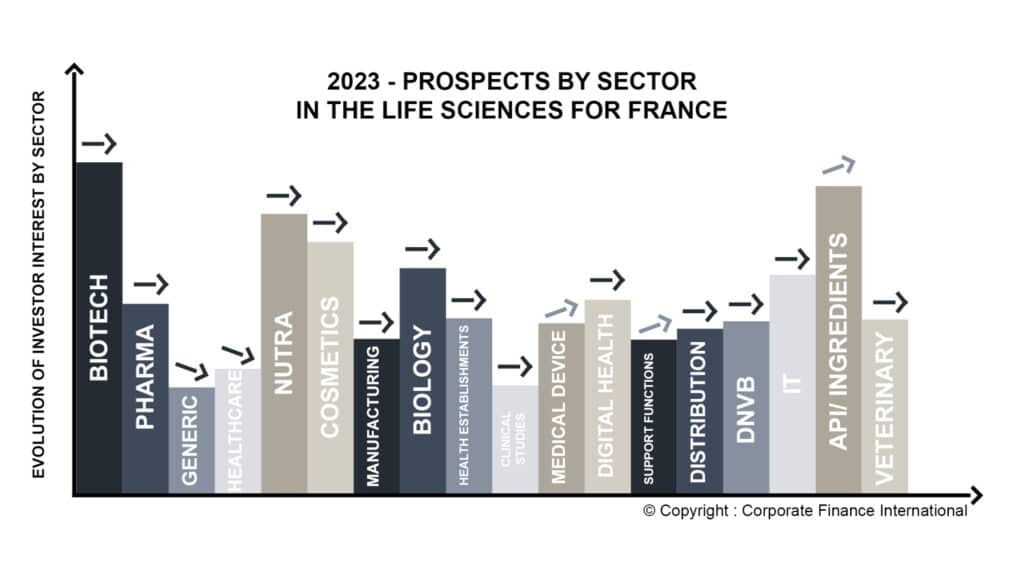

Below is our perception of the evolution of the Life Sciences sub-sectors in Europe at the start of this new year 2023 in relation to investor interest.

2023 is starting in an uncertain and difficult context in Europe and around the world.

Below is our perception of the evolution of the Life Sciences sub-sectors in Europe at the start of this new year 2023 in relation to investor interest.

Increasing:

The biggest change in 2023 could come from the MD or medical device sector following Europe’s proposal to postpone the adoption of MDR from 2024 to 2028. In a context of reduced margins in the pharmaceutical industry, the medical device should once again become a more sought-after sector for solid targets that have not developed their activity solely around the Covid crisis. We can expect a larger number of transactions and rising valuations.

Similarly, the Services subsector for the Life Science sector, which is still very fragmented, should see many small and medium-sized operations in 2023, in order to constitute several key players in this field to compete with current 2 european main players.

Breaks in health products are not linked to a lack of capacity among manufacturers of finished products, but to the complex supply chain to bring what are called intermediaries and active ingredients to Europe. The API/Assets sector, already very well valued, will continue to attract even more investors, with probably a limited number of transactions due to the low number of opportunities, but with valuations sometimes becoming those of biotech.

Decreasing:

The Generic sector is no longer profitable due to cost exposure. Already highly concentrated in Europe, this market could consolidate further on the basis of still declining valuations, not to mention that some of the big European players will be on sale in 2023.

The same applies to the Healthcare market for non-reimbursed drugs, which is also affected by price increases, but which can be passed on to the patient.