France

CFI France - Athema

Your local advisor

Paris

31 Rue du Colisée

75008 Paris

France

T: +33 1 44 13 88 00

E: paris@thecfigroup.com

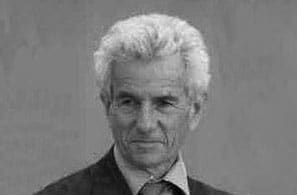

Jean-Marc Teurquetil

Partner, Managing DirectorBackground

CFI France provides mid-market companies and private equity investors with a variety of comprehensive advisory services including M&A, capital raising, debt advisory, restructuring and real estate financing.

As part of CFI Group, CFI France – Athema provides its clients with the resources to allow the most suitable strategic buyers or financial investors to acquire French companies. CFI France also advises its French clients in identifying relevant acquisition targets in more than 20 countries.

As a multi-sector specialist, CFI France - Athema understands the importance of industry knowledge. Our sector teams provide advisory services combined with strategic market insight, which results in an ability to deliver high quality sector-based transaction advice and getting the right counter parties involved. Sectors covered include: Industrials, IT/Software, Business Services, Food & Beverage, Retail, Energy, Real Estate and Aeronautics.

This combined Sector and Geography approach, along with a strong track record of more than 100 transactions, positions CFI France as one of the key M&A players for mid-market companies in France.

Contact our local team

Jean-Marc Teurquetil

Partner, Managing Director

Frédéric Damiron

Director

Jacques Ropartz

Director

Yoann Msika

Director

Clément Richard

Director

Jean-Baptiste Duval

Director

Alexis Dubil

Director

Dominique Ciccone

Senior Advisor

Jean Claude Saltiel

Senior Advisor

Lionel Bordarier

Senior Advisor

Olivier Dupont

Senior Advisor

Philippe Lazare

Senior Advisor

Philippe Ruelle

Senior Advisor

Sébastien Lambert

Vice President

Xinyue Zhang

Vice President

Charlotte Mélin

Vice President

Illan Samama

Vice PresidentNews & insights

Sector focus

CFI employs a specialised sector focus that supports in-depth understanding of trends, recent innovations, and fluctuating regulations affecting our clients. Fostering a culture of real-time collaboration across the firm, CFI organises itself into 16 international sector teams.

Our latest transactions

Paper, Plastics & Packaging

has been sold to

Transaction details

Adriaansen, a distributor of premium industrial packaging products in Belgium and Luxembourg, has been sold to SC Pack, a leader in the French industrial packaging distribution market, as well as in the production of PE jerrycans and PET bottles