Finland

CFI Finland

Your local advisor

Pasi Vainiotalo

Partner, Managing Director

Jaakko Sasi

Partner, Managing DirectorBackground

Initia Corporate Finance is an independent mid-market corporate finance advisor leveraging decades of experience in sell-side and buy-side advisory, financing arrangements and other financial advisory.

We are dedicated to supporting our clients with transactions that enhance long-term shareholder value by offering comprehensive, efficient and pragmatic advisory services. Our expertise and integrity combined with a highly committed project team ensure the best outcome for our clients with every assignment.

We have executed more than 150 successful M&A transactions and financing arrangements with a cumulative value exceeding EUR 5 billion. Our clients mainly consist of entrepreneurs, corporations, family offices, and private equity firms. With our assistance, many of them have continued to improve their competitiveness and shareholder value throughout the years.

Contact our local team

Jaakko Sasi

Partner, Managing Director

Pasi Vainiotalo

Partner, Managing Director

Jaakko Lehto

Partner, Managing Director

Lauri Pohjavuori

Partner, Managing Director

Markku Tervo

DirectorNews & insights

Sector focus

CFI employs a specialised sector focus that supports in-depth understanding of trends, recent innovations, and fluctuating regulations affecting our clients. Fostering a culture of real-time collaboration across the firm, CFI organises itself into 16 international sector teams.

Aerospace & Defence

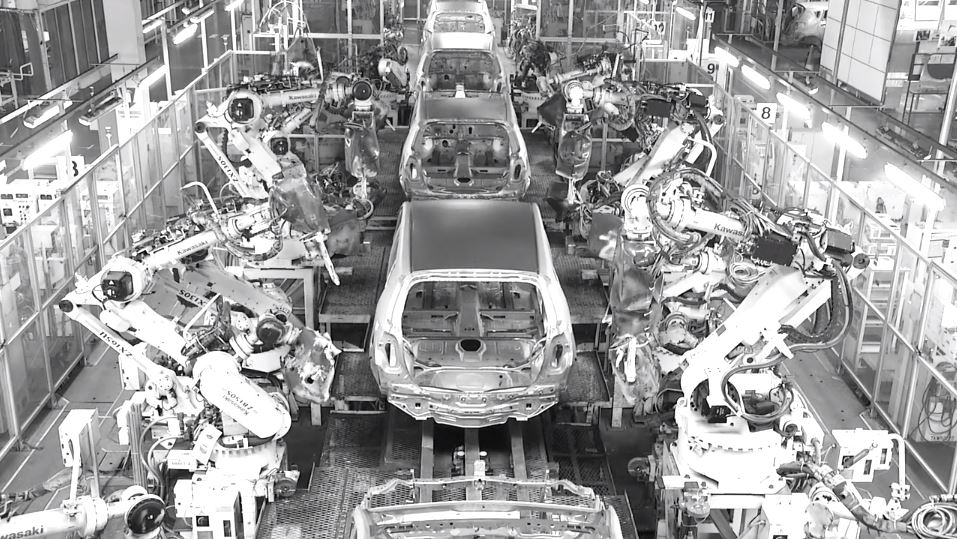

Automotive

Business Services

Chemicals

Consumer Goods & Retail

Energy, Environment & Natural Resources

Food & Beverage & Agribusiness

Healthcare & Life Sciences

Industrials

Machinery

Media & Telecom

Paper, Plastics & Packaging

Private Equity

Real Estate & Construction

Software & IT Services

Transport & Logistics

Our latest transactions

Business Services

has been acquired by

Transaction details

B2B Finnish cleaning company Puhdas Group has been acquired by Reldo, backed by Celero Capital

Consumer Goods & Retail

and

have been acquired by

Transaction details

Asia Exchange, the biggest study abroad organisation for adults, and Edunation, an international student recruitment company, have been acquired by Keystone Education Group

Media & Telecom

has sold the sheet-fed printing business of

to

Transaction details

Leading Finnish media provider Keskisuomalainen Oyj has sold its sheet-fed printing business to PunaMusta Media