Benelux Digital Marketing Agency landscape

Wim Folens

Partner, Managing Director

Raoul Duysens

Partner, Managing Director

Sebastiaan Renting

Vice PresidentWhich way for the Benelux Digital Marketing Agency landscape?

Summary: The Evolution and M&A Developments of Benelux Digital Marketing Agencies

The Benelux boasts a dynamic landscape of digital marketing agencies marked by innovation and creativity. With specialised independent agencies and strong consolidation by platforms, the region stands out as a hub of digital marketing excellence.

The Benelux has played a key role in shaping the digital marketing landscape. The industry has experienced substantial growth and diversification, with a shift toward data-driven marketing. Independent niche agencies have emerged, offering deep expertise in specific areas with their own way of working and DNA. This has led to a wave of consolidation, in partnership between agencies and investors, where large digital marketing platforms were formed in the Benelux, each with their own strategic approach, benefits, synergies and focus areas.

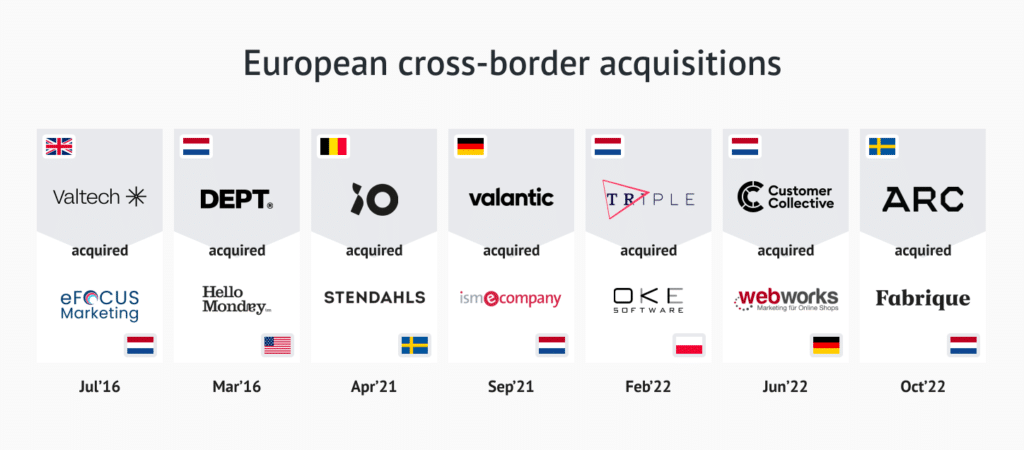

In the current maturing landscape, internationalisation is a prominent trend, evidenced by cross-border (strategic) deal activity. Furthermore, challenges around data & privacy, focus on sustainable branding & marketing and implications of Web 3.0 and AI on e.g. content & development are shaping the future of the industry. The landscape is expected to see sustained international M&A activity, offering a wide range of strategic choices for entrepreneurs.

The Benelux territory, spanning the Netherlands, Belgium and Luxemburg, is home to a tremendous number of digital marketing agencies. Clearly, the Benelux market for digital marketing provides fertile soil for its thriving creative and entrepreneurial workforce. Developments in this relatively modest territory include increasing differentiation of independent specialists with distinct and focused profiles (expertise, client, segment), strong and steady consolidation by new and established platforms (Happy Horizon, United Playgrounds, Springbok, and 4NG), and the integration of European markets by international groups (valantic, ARC, Myty; IO, Triple).

With the European market for digital marketing poised for continued growth and evolution over the next couple of years, we explore current developments and look at where the market is heading.

The Benelux: Pioneering Digital Innovation

With its innovative and pioneering spirit, adaptability and contributions to digitisation, the Benelux has played a pivotal role in the evolution of the digital marketing agency landscape, from its early beginnings to its current prominence.

The Netherlands, with a rich history of digital innovation, saw some of its earliest digital marketing agencies emerging in the late 1990s and early 2000s. This period marked the nascent stage of the internet, and Dutch entrepreneurs seized the opportunity to harness its potential for businesses and consumers. Lost Boys, founded in 1993, is often cited as one of the earliest digital agencies in the Netherlands. With a focus on innovative web design and interactive projects, Lost Boys set the stage for the digital revolution in the country. They created websites and interactive campaigns, laying the foundation for future digital marketing agencies.

Meanwhile, Belgium, with its rich cultural heritage and creative talent pool, fostered the growth of digital marketing agencies with a strong emphasis on creativity, design, and user experience (UX). Agencies like These Days, founded in 2001, established themselves as creative digital pioneers to craft digital strategies and campaigns that resonated with audiences. Belgium’s close proximity to EU institutions in Brussels also played a role in fostering digital innovation and projects related to policy, communication, and public affairs.

Growth and Diversification

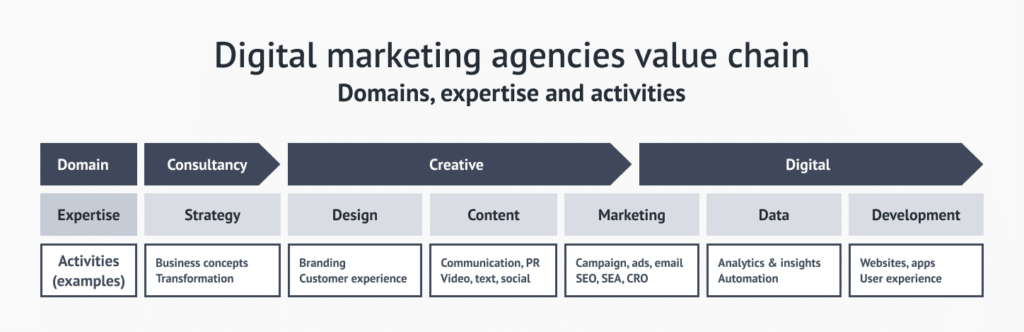

In the early days, traditional global multimedia networks such as Omnicom and WPP dominated the market, serving large corporates. But as the internet evolved into Web 2.0, providing broader market access and introducing new channels and solutions for building digital products and customer interactions, the market changed. The surge in content, social media and e-commerce laid the groundwork for data-driven marketing and automation. Agencies started leveraging data for targeted and personalised campaigns, customer activation and engagement, and data-driven decision-making.

“In the UK, the high marketing per capita spend has made UK frontrunner in terms of number and development of digital marketing agencies”

Geraint Rowe, Partner/Managing Director CFI UK

The combination of a broader range of services and rapid growth, driven by increased marketing expenditure and a shift to outsourced services, led to the emergence of independent niche agencies. Specialisation enabled businesses to partner with agencies with deep expertise in specific areas, for increasingly tailored and effective solutions. These differentiated propositions, whether in expertise or domain focus, helped agencies overcome project risks, add value, and foster client recurrence. Other agencies adopted a one-stop-shop (‘full-service’) approach, offering a comprehensive suite of services for businesses seeking to establish and maintain a robust online presence.

Consolidation and Investor Involvement

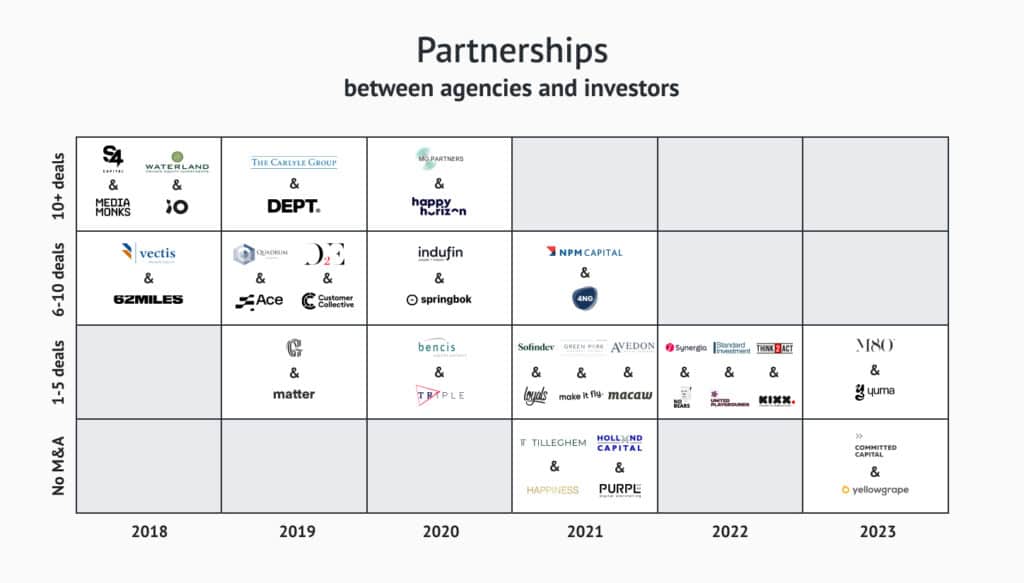

The newly fragmented and diversified market, fuelled by strong growth, attracted investors keen to seize its acquisition strategy opportunities.

This not only accelerated growth but also boosted talent attraction in a tight labour market, scalability for winning larger projects, cross-selling opportunities, and operational synergies. Several large Benelux ‘platforms’ were built during this consolidation phase.

TamTam (now DEPT), established in 1995, specialised in web development and played a crucial role in shaping the Dutch digital landscape. It partnered with investor Waterland and acquired approximately 15 companies between 2015-2019.

From 2017 onwards, consolidation intensified, leading to the establishment of additional platforms by investors entering the market for digital marketing agencies with new and more sophisticated routes and targeted strategies, buy-and-build or otherwise. Examples include 62Miles (Vectis) and Ace (Quadrum Capital).

“Netvlies had existed for over 23 years, when we saw the competition getting bigger and a major consolidation in the market. After talking to some of our contacts in the market that had already jumped, we decided to stay ahead of the game, and decided to join a larger group.”

Jochem Vlemmix, Founder Netvlies, part of 4NG

Internationalisation

The acquisition drive was partly inspired by the aim of gaining cross-border footholds to facilitate international competition and meet challenges posed by local barriers and player’s established positions.

This was particularly evident in Belgium and the Netherlands, two countries that not only share a border but also a similar language and culture. Benelux platforms, including Springbok, Customer Collective, 62Miles, and IO, were created through impressive M&A track records.

As the Benelux market matured and consolidated, several platforms aimed to expand across Europe. Agencies in neighbouring regions including the UK and the DACH and Nordics territories became increasingly involved in deals both into and out of the Benelux. For instance, MediaMonks, founded in 2001, quickly gained recognition for its creative and interactive digital work for global brands and grew to 750 employees in 10 countries with financial support from its shareholder Bencis.

“French agencies are rapidly expanding across the border, like SQLI with a presence in UK, Benelux, DACH and Morocco and Fred & Farid with presence in China, the US and other European countries”

Jean-Marc Tuerquetil, Partner/Managing Director CFI France

“In the Nordics we have a vibrant market for digital experiences, with similar labour market dynamics and culture compared to the Benelux region; last few years we see increased deal activity between these geographies.”

Erik Arvidsson, Partner/Managing Director CFI Sweden

Current Landscape and Future Challenges

The current digital marketing agency landscape in the Benelux is marked by diversity and specialisation.

Agencies have honed their skills to cater to specific industries and disciplines, resulting in a nuanced and varied landscape.

Industry associations such as Dutch Digital Agencies (DDA) have witnessed an expansion of their base, simultaneously to the proliferation of nominations and categories of awards such as the Emerce100, indicating the maturation of the market.

Awards

Industry Associations

The future of this landscape is poised between challenges and opportunities. The advent of Web 3.0 and artificial intelligence is set to enhance technological capabilities, reshaping every discipline and step in the value chain. Agencies are proactively investing in technology and skills to stay at the forefront of these developments, unlocking numerous opportunities for creativity, automation, and overall efficiency in marketing efforts.

However, challenges loom on the horizon. More stringent privacy regulations, such as GDPR legislation and restrictions on targeted/personalised ads, may hamper marketing efforts and automation. Agencies must prioritise compliance and user data protection in their strategies. Additionally, sustainability and purpose-driven marketing have gained prominence in both countries. Agencies are increasingly focusing on helping businesses align with these values, reflecting a growing emphasis on environmental and social responsibility.

“AI has and will significantly impact digital marketing agencies by enhancing efficiency, personalisation, and decision-making processes. AI in programmatic advertising, allows agencies to optimise ad placements in real-time based on user behaviour. Agencies need to upskill teams to leverage AI tools effectively and address concerns about data privacy and ethical use of AI in marketing strategies.”

Johan Keurentjes, Managing Director DNZ

Conclusion

Over the last 25 years, the marketing landscape in the Benelux and Europe has transformed, driven by developments in digital technology and changing consumer behaviour. This transformation has resulted in a profound shift from traditional networks to digital marketing agency platforms across Europe.

The ongoing evolution of consumer behaviour and technology will continue to shape the digital landscape. Agencies with a solid foothold, proprietary tools, distinctive DNA and culture, and a clearly outlined proposition must keep pace in this ever-changing and dynamic environment. Entrepreneurs find themselves at a strategic crossroads, deciding between continuing to build independently or joining the journey of a platform with a shared vision and DNA. Investor-backed platforms, typically in collaboration for four to seven years, will reach maturity and potentially partner with new shareholders. As the Europeanisation of the market continues, this is expected to build interesting momentum and generate sustained international M&A activity over the next few years.

If you would like to know more about our experience in the Digital Marketing Sector, then please do not hesitate to contact our industry specialists Raoul Duysens, Wim Folens and Sebastiaan Renting.

In this video Remco van Blitterswijk, Founder and CEO of Frontmen, discusses the sale of Frontmen to iO and explains why they selected CFI’s Software & IT Services team in the Benelux as their lead M&A advisor.